Latin America Implantable Medical Devices Market Size, Share, Trends & Growth Forecast Report By Implant Type (Cardiovascular, Orthopedic, Dental, Ophthalmic, Cochlear, Cosmetic, Others), Biomaterial (Metallic, Polymeric, Ceramic, Others), End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Others), and Country (Brazil, Mexico, Argentina, Chile, Rest of Latin America) – Industry Analysis From 2025 to 2033.

Latin America Implantable Medical Devices Market Size

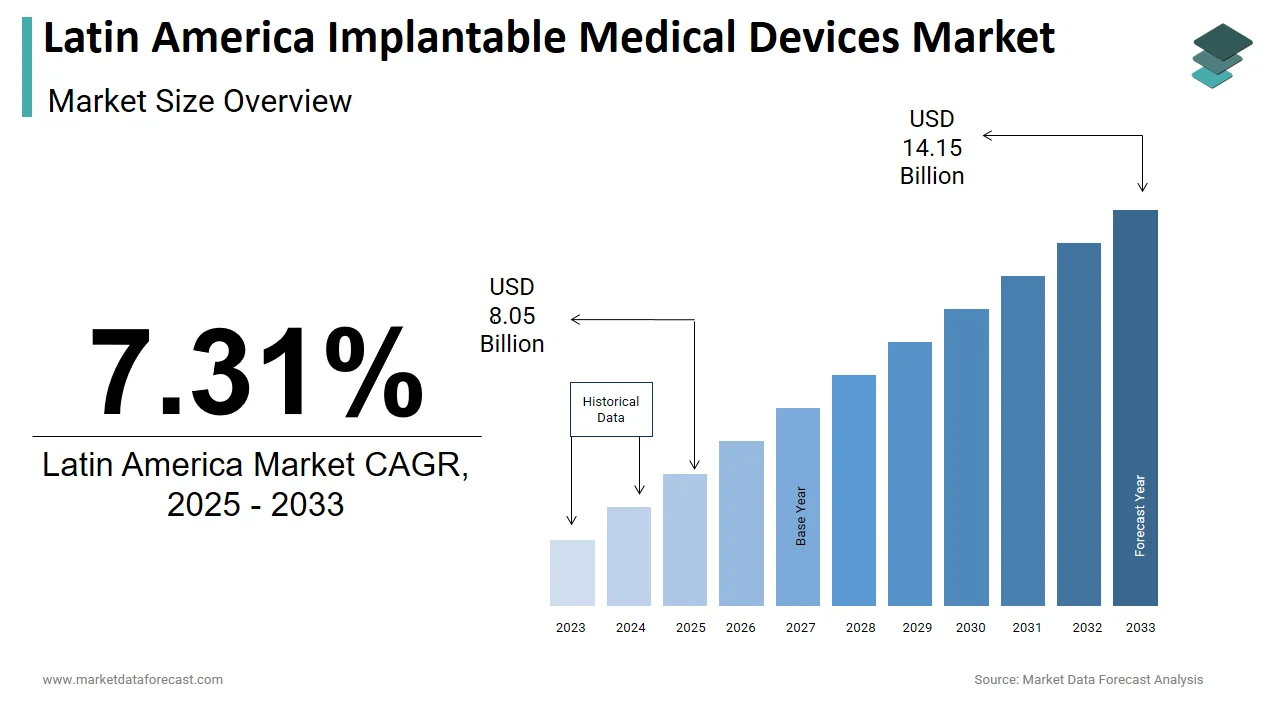

The size of the Latin America implantable medical devices market was valued at USD 7.50 billion in 2024. This market is expected to grow at a CAGR of 7.31% from 2025 to 2033 and be worth USD 14.15 billion by 2033 from USD 8.05 billion in 2025.

The Latin America implantable medical devices market encompasses a broad range of technologically advanced products designed to be placed inside the human body for therapeutic, diagnostic, or monitoring purposes. These include cardiac pacemakers, implantable cardioverter-defibrillators (ICDs), orthopedic implants, neurostimulators, intraocular lenses, and drug-eluting stents, among others. Additionally, as per the World Bank, life expectancy in the region has risen steadily over the past two decades, contributing to a growing elderly demographic that requires long-term medical interventions. This shift has prompted both public and private healthcare providers to invest in modern surgical infrastructure and advanced treatment modalities. Moreover, countries like Brazil, Mexico, and Argentina have witnessed increased regulatory harmonization efforts, enabling faster approvals for high-quality imported and locally manufactured devices.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases and Cardiovascular Conditions

A major driver of the Latin America implantable medical devices market is the increasing incidence of chronic diseases, particularly cardiovascular disorders. This growing burden has significantly elevated the demand for implantable cardiac rhythm management devices such as pacemakers and defibrillators. Moreover, the expansion of public health coverage under initiatives like Mexico’s Instituto de Salud para Bienestar (INSABI) has enhanced patient access to complex cardiac interventions, including device-based therapies. Apart from these, rising awareness among physicians and patients about the benefits of early intervention with implantable devices has contributed to higher adoption rates.

Expansion of Healthcare Infrastructure and Private Sector Investment

Another key driver of the Latin America implantable medical devices market is the rapid expansion of healthcare infrastructure, particularly in the private sector. This trend has led to the development of specialized hospitals, ambulatory surgical centers, and high-end clinics equipped to perform implantation procedures. These facilities often collaborate with international device manufacturers to ensure access to cutting-edge technologies. Furthermore, strategic investments by multinational firms have played a crucial role in shaping the market landscape.

MARKET RESTRAINTS

High Cost of Implantable Devices and Limited Patient Affordability

One of the primary restraints affecting the Latin America implantable medical devices market is the high cost associated with these advanced technologies, which limits widespread patient access. Even in countries with relatively developed healthcare systems, such as Chile and Brazil. Public healthcare systems, while providing essential services, often face budget constraints that delay procurement and limit the availability of newer-generation devices. Additionally, price disparities between imported and locally produced devices create accessibility gaps. Imported devices from companies like Boston Scientific and Biotronik often come with premium pricing, while domestic alternatives may lack regulatory approval or clinical validation.

Regulatory Complexity and Lengthy Approval Processes

Regulatory complexity and prolonged approval timelines present a significant challenge for manufacturers operating in the Latin America implantable medical devices market. Unlike the streamlined framework of the U.S. Food and Drug Administration (FDA) or the European Union’s CE marking system, Latin American countries maintain diverse and often cumbersome regulatory regimes. These inefficiencies discourage smaller firms from entering the market, limiting product diversity and competition. Moreover, inconsistent post-market surveillance practices across the region reduce transparency and complicate recall or safety alert mechanisms. This fragmented environment increases compliance burdens for multinational firms and restricts the timely availability of innovative implantable technologies to Latin American patients.

MARKET OPPORTUNITIES

Growing Adoption of Telemedicine and Remote Monitoring Technologies

An emerging opportunity within the Latin America implantable medical devices market is the increasing integration of telemedicine and remote monitoring capabilities into implantable solutions. As digital health platforms expand across the region, there is a rising demand for connected devices that enable real-time patient tracking and data transmission to healthcare providers. Manufacturers are responding by developing implantable devices equipped with wireless connectivity features, such as cardiac monitors and neurostimulators that transmit vital data directly to cloud-based systems. With continued investment in digital health infrastructure and regulatory support, Latin America is well-positioned to become a key market for next-generation smart implantables.

Rise in Medical Tourism and Cross-Border Healthcare Services

Medical tourism presents a compelling growth avenue for the Latin America implantable medical devices market, as the region increasingly attracts international patients seeking high-quality yet cost-effective treatments. Countries such as Mexico, Costa Rica, and Colombia have established themselves as preferred destinations for elective surgeries, including joint replacements and cardiac procedures that involve implantable devices. Facilities in cities like Guadalajara and Bogotá offer state-of-the-art implantation services at a fraction of the cost seen in the United States and Europe, drawing patients primarily from North America and the Caribbean. Many of these hospitals are JCI-accredited and partner with global device suppliers to ensure the use of premium-grade implants. Also, governments in the region are actively promoting medical tourism through visa facilitation programs and dedicated healthcare corridors.

MARKET CHALLENGES

Supply Chain Disruptions and Component Shortages

A critical challenge confronting the Latin America implantable medical devices market is the vulnerability of its supply chain to global disruptions and component shortages. As most high-end implantable devices rely on precision-engineered materials and electronic components sourced from Asia and Europe, geopolitical tensions, trade restrictions, and logistical bottlenecks have significantly impacted availability. Local manufacturing capabilities remain limited, especially for complex implants such as neurostimulators and drug-eluting stents. In Brazil, for instance, only a handful of domestic firms produce basic orthopedic implants, leaving the majority of demand reliant on imports. Semiconductor shortages in recent years disrupted the production of cardiac rhythm management devices across multiple Latin American markets, resulting in extended wait times for patients. Moreover, customs clearance inefficiencies and fluctuating currency exchange rates add financial unpredictability for distributors.

Lack of Skilled Professionals and Specialized Training Programs

A persistent challenge in the Latin America implantable medical devices market is the shortage of trained professionals capable of performing complex implantation procedures. Despite improvements in medical education, there remains a significant gap in the availability of specialists such as interventional cardiologists, orthopedic surgeons, and neurosurgeons proficient in advanced implant techniques. According to the Pan American Health Organization (PAHO), the ratio of specialized surgeons per capita in Latin America is nearly half that of developed regions like North America and Western Europe. In rural and underserved areas, the scarcity of skilled practitioners is even more pronounced. Similarly, in Bolivia and Paraguay, training programs for minimally invasive implant procedures remain limited, constraining the adoption of newer-generation devices. To address this issue, some governments and academic institutions have initiated collaborative training programs with international medical organizations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Implant Type, End User, Biomaterial, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

Brazil, Mexico, Argentina, Chile & Rest of Latin America |

|

Market Leaders Profiled |

Medtronic plc, Abbott, Koninklijke Philips N.V., B. Braun Melsungen AG, Becton, Dickinson and Company, Terumo Medical Corporation, Johnson & Johnson, Stryker Corporation, Smith+Nephew, Dentsply Sirona, and others. |

SEGMENTAL ANALYSIS

By Implant Type Insights

The cardiovascular implants segment dominated the Latin America implantable medical devices market by holding an estimated market share of 37.4% in 2024. This segment includes pacemakers, implantable cardioverter-defibrillators (ICDs), coronary stents, and heart valves, which are essential for managing a wide range of cardiac conditions. The dominance of this category is primarily attributed to the rising prevalence of cardiovascular diseases across the region. In Brazil alone, over 320,000 people suffer from arrhythmias that may require pacemaker implantation, as reported by the Brazilian Society of Cardiology. Additionally, aging populations in countries like Mexico and Argentina have contributed to increased demand for cardiac rhythm management devices. Moreover, public health programs such as Mexico’s INSABI and Brazil’s SUS have expanded coverage for cardiac procedures, improving patient access.

The ophthalmic implants represented the fastest-growing segment in the Latin America implantable medical devices market, projected to expand at a CAGR of approximately 11.4%. This development is propelled by increasing incidences of vision impairment, cataracts, and age-related macular degeneration, particularly among the aging population. In response, governments have launched initiatives to improve access to corrective surgeries. Additionally, rising disposable incomes and growing awareness about refractive error correction through premium implants have fueled demand. Private clinics in Chile and Peru are increasingly offering advanced multifocal and toric intraocular lenses, attracting patients seeking long-term vision solutions.

By End-User Insights

The hospitals remained the largest end-user segment in the Latin America implantable medical devices market by capturing 62% of total utilization in 2024. This control is largely due to the presence of well-established surgical departments, availability of specialized medical professionals, and integration with public and private insurance systems that facilitate complex implant procedures. Public hospitals, especially in Brazil and Argentina, continue to be the primary sites for subsidized implant procedures such as pacemaker insertions and orthopedic joint replacements. Meanwhile, private hospital chains in Chile and Colombia are investing heavily in state-of-the-art operating theaters equipped with advanced implant technologies. Furthermore, regulatory compliance and centralized procurement policies make hospitals the preferred destination for high-risk implantable devices.

Ambulatory Surgical Centers (ASCs) are emerging as the fastest-growing end-user segment in the Latin America implantable medical devices market, registering a projected CAGR of around 9.8% during the forecast period. This progress is fueled by increasing preference for minimally invasive procedures, shorter recovery times, and lower procedural costs compared to traditional hospital settings. These centers specialize in outpatient implant procedures such as dental implants, certain orthopedic interventions, and minor cosmetic enhancements, aligning with shifting consumer preferences toward convenience and affordability. Additionally, regulatory reforms in several countries now allow ASCs to perform a broader range of implant-based surgeries, enhancing their clinical capabilities. With favorable reimbursement policies and technological advancements, ASCs are rapidly transforming into key players in the implantable devices landscape.

COUNTRY LEVEL ANALYSIS

Brazil prevailed in the Latin America implantable medical devices sector. Positioned as the region’s most developed healthcare market, it benefits from a combination of a large patient pool, growing chronic disease burden, and expanding public-private healthcare infrastructure. According to the Brazilian Institute of Geography and Statistics (IBGE), life expectancy in the country has risen to over 76 years, contributing to a surge in age-related conditions requiring implants, such as cardiovascular and orthopedic disorders. Moreover, Brazil has one of the most structured regulatory frameworks in Latin America, with ANVISA streamlining approval processes for imported and domestic devices.

Mexico’s strategic location, strong trade ties with North America, and a rapidly modernizing healthcare system contribute to its competitive position in the regional market. This trend has directly influenced the demand for cardiac implantable electronic devices (CIEDs), supported by INSABI’s expanded coverage for low-income patients. Additionally, Mexico serves as a key production hub for global medical device manufacturers, benefiting from existing supply chain linkages with the United States. The proliferation of private hospitals and ambulatory surgical centers has further enhanced accessibility, making Mexico a pivotal player in the Latin American implantable devices ecosystem.

Argentina is positioning itself as a key contributor due to its relatively advanced healthcare system and growing elderly population. The country’s public health infrastructure, combined with a robust private sector, supports the adoption of implantable technologies across multiple therapeutic areas. This demographic shift has led to a corresponding increase in demand for orthopedic and cardiovascular implants, particularly in Buenos Aires and Córdoba provinces. Moreover, Argentina has been strengthening its regulatory alignment with international standards, allowing faster approvals for imported devices.

Chile holds a smaller market share of the Latin America implantable medical devices market, driven by high healthcare expenditure, strong regulatory oversight, and a well-developed private health insurance system. The country maintains one of the most efficient healthcare models in the region, ensuring broad access to advanced medical treatments. Additionally, Chile has been proactive in adopting digital health technologies, integrating electronic health records with implant tracking systems to enhance post-operative monitoring. Also, the country’s regulatory body, ISP, has streamlined approval pathways for high-risk devices, encouraging innovation and foreign investment. These developments reinforce Chile’s role as a leader in medical device adoption within Latin America.

The Rest of Latin America (ROLA) comprising countries such as Colombia, Peru, Ecuador, Costa Rica, and Central American nations. While individually smaller in scale, these markets are experiencing rapid growth due to improving healthcare infrastructure, increasing government spending, and rising medical tourism. The Colombian Ministry of Health also noted a significant rise in the number of JCI-accredited hospitals, which has boosted confidence among both domestic and international patients seeking implant-based treatments.

KEY MARKET PLAYERS

Noteworthy Companies dominating the Latin America Implantable medical devices market Profiled in the report are Medtronic plc, Abbott, Koninklijke Philips N.V., B. Braun Melsungen AG, Becton, Dickinson and Company, Terumo Medical Corporation, Johnson & Johnson, Stryker Corporation, Smith+Nephew, Dentsply Sirona, and others.

TOP LEADING PLAYERS IN THE MARKET

Medtronic (Ireland-based, with a strong presence across Latin America)

Medtronic is a global leader in medical technology and maintains a dominant position in the Latin America implantable medical devices market. The company offers a broad portfolio including cardiac rhythm management devices, neurostimulators, orthopedic implants, and vascular stents. In Latin America, Medtronic has established a robust distribution network and collaborates closely with public and private healthcare institutions to enhance access to advanced therapies.

Abbott Laboratories (U.S.-based, active across multiple Latin American markets)

Abbott plays a crucial role in shaping the region’s implantable devices landscape through its cardiovascular and diabetes care divisions. The company is known for its innovative coronary stent technologies and continues to expand its footprint in Latin America via strategic partnerships, regulatory approvals, and physician training programs that support device adoption and long-term patient outcomes.

Braun Melsungen AG (Germany-based, growing influence in Latin America)

Braun has been steadily expanding its presence in Latin America by focusing on surgical implants and pain management solutions. With a commitment to affordability and clinical excellence, the company works closely with local distributors and government agencies to improve access to high-quality implantable products across both urban and rural healthcare settings.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the most effective strategies employed by key players in the Latin America implantable medical devices market is local manufacturing and assembly partnerships. By collaborating with domestic firms or setting up regional production units, companies reduce import costs, streamline supply chains, and align more closely with national healthcare policies that favor locally produced goods.

Another critical approach is regulatory engagement and product localization. Leading firms actively participate in policy discussions, seek fast-track approvals for essential implants, and tailor their product offerings to meet specific clinical needs observed in different Latin American countries.

A third major strategy involves physician education and clinical training programs. Companies are investing heavily in workshops, simulation labs, and continuing medical education initiatives to build trust among surgeons, cardiologists, and hospital administrators, ensuring sustained demand for their implantable technologies.

COMPETITION OVERVIEW

The Latin America implantable medical devices market is highly competitive, marked by the coexistence of multinational corporations and emerging regional players. Global leaders such as Medtronic, Abbott, and Boston Scientific maintain a strong foothold due to their technological expertise, extensive distribution networks, and well-established brand reputations. These companies frequently engage in strategic collaborations, localized product launches, and regulatory alignment efforts to reinforce their dominance.

At the same time, smaller domestic manufacturers and regional distributors are increasingly entering the space, often offering cost-effective alternatives that appeal to budget-sensitive public health systems. This dual dynamic creates a fragmented yet rapidly evolving market structure where innovation, pricing, and regulatory adaptability play decisive roles.

Competition is further intensified by rising demand for minimally invasive implants, increased healthcare expenditure, and the expansion of private insurance coverage. As market access improves and new entrants emerge, the battle for market share is shifting toward differentiated product portfolios, enhanced after-sales services, and stronger clinical validation strategies tailored to Latin American patient profiles.

RECENT MARKET DEVELOPMENTS

- In March 2024, Medtronic launched a new cardiac rhythm management training center in São Paulo, Brazil, aimed at equipping local physicians with advanced skills in pacemaker and defibrillator implantation procedures.

- In August 2023, Abbott signed a distribution agreement with a leading Mexican healthcare supplier to expand the reach of its drug-eluting stent portfolio across public hospitals and private clinics in central and southern Mexico.

- In January 2024, B. Braun partnered with an Argentinean research institute to develop cost-effective spinal implant solutions tailored to the needs of patients in South America, with plans to commercialize them within two years.

- In November 2023, Boston Scientific initiated a digital health pilot program in Colombia, integrating remote monitoring capabilities into its implantable cardiac devices to improve post-operative patient management and data collection.

- In May 2024, Johnson & Johnson expanded its orthopedic implants manufacturing unit in Costa Rica, reinforcing its regional supply chain and supporting export opportunities to neighboring Latin American countries.

MARKET SEGMENTATION

This Latin America implantable medical devices market research report is segmented and sub-segmented into the following categories.

By Implant Type

- Cardiovascular Implant

- Orthopedic Implants

- Dental Implants

- Ophthalmic Implants

- Cochlear Implants

- Cosmetic Implants

- Others

By Biomaterial

- Metallic

- Polymeric

- Ceramic

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

By Country

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

1. What factors are fueling the Latin America implantable medical devices market?

The Latin America implantable medical devices market is fueled by rising chronic diseases, expanding healthcare infrastructure, and increased public-private investment in advanced surgical technologies across major countries.

2. Which barriers are currently affecting the Latin America implantable medical devices market?

Barriers in the Latin America implantable medical devices market include high device costs, complex regulatory environments, supply chain disruptions, and a shortage of trained specialists for advanced implantation procedures.

3. Where do the best opportunities for expansion exist in the Latin America implantable medical devices market?

Opportunities in the Latin America implantable medical devices market lie in telemedicine integration, local manufacturing partnerships, growth in medical tourism, and expanding physician training for next-generation smart implants.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com